All Categories

Featured

Table of Contents

That commonly makes them a more budget-friendly option for life insurance policy protection. Lots of individuals get life insurance policy coverage to assist economically shield their loved ones in situation of their unanticipated fatality.

Or you may have the alternative to convert your existing term protection into an irreversible plan that lasts the remainder of your life. Different life insurance plans have potential benefits and disadvantages, so it's important to comprehend each prior to you choose to purchase a plan.

As long as you pay the costs, your beneficiaries will certainly receive the survivor benefit if you die while covered. That claimed, it is essential to keep in mind that the majority of plans are contestable for two years which implies insurance coverage can be retracted on fatality, ought to a misrepresentation be found in the application. Plans that are not contestable commonly have a graded death benefit.

What is Level Term Life Insurance Policy? Pros, Cons, and Considerations?

Costs are normally reduced than entire life plans. You're not locked right into an agreement for the remainder of your life.

And you can't pay out your policy throughout its term, so you won't obtain any monetary gain from your past coverage. Just like other kinds of life insurance policy, the expense of a degree term policy depends on your age, coverage demands, work, way of living and health and wellness. Typically, you'll discover a lot more inexpensive protection if you're younger, healthier and less risky to guarantee.

Considering that degree term costs stay the same throughout of protection, you'll understand precisely just how much you'll pay each time. That can be a huge assistance when budgeting your expenses. Degree term insurance coverage additionally has some versatility, enabling you to customize your policy with extra features. These frequently can be found in the type of motorcyclists.

Understanding the Benefits of Term Life Insurance With Accidental Death Benefit

You may need to fulfill specific problems and certifications for your insurance firm to establish this biker. On top of that, there might be a waiting duration of as much as six months before working. There likewise could be an age or time restriction on the protection. You can include a child motorcyclist to your life insurance policy policy so it also covers your youngsters.

The death advantage is usually smaller sized, and insurance coverage generally lasts up until your youngster transforms 18 or 25. This motorcyclist might be a more cost-efficient way to assist ensure your youngsters are covered as riders can typically cover numerous dependents simultaneously. As soon as your child ages out of this protection, it might be possible to convert the rider into a brand-new policy.

When contrasting term versus long-term life insurance coverage, it is essential to bear in mind there are a few different kinds. One of the most typical kind of irreversible life insurance policy is entire life insurance, yet it has some essential distinctions compared to level term coverage. Short Term Life Insurance. Right here's a standard review of what to take into consideration when comparing term vs.

Entire life insurance policy lasts for life, while term coverage lasts for a certain period. The premiums for term life insurance policy are normally lower than entire life coverage. Nevertheless, with both, the costs remain the very same for the period of the policy. Entire life insurance policy has a cash worth part, where a portion of the costs may expand tax-deferred for future needs.

One of the primary attributes of degree term protection is that your costs and your survivor benefit don't change. With lowering term life insurance policy, your costs stay the same; nonetheless, the survivor benefit amount obtains smaller sized in time. You may have insurance coverage that starts with a fatality benefit of $10,000, which could cover a home mortgage, and then each year, the fatality benefit will lower by a collection amount or portion.

Due to this, it's frequently a much more cost effective type of level term protection., however it may not be enough life insurance policy for your requirements.

What is the Purpose of Short Term Life Insurance?

After picking a plan, complete the application. For the underwriting process, you may need to give general individual, health, way of life and work info. Your insurance company will figure out if you are insurable and the danger you might present to them, which is mirrored in your premium costs. If you're approved, sign the documentation and pay your very first costs.

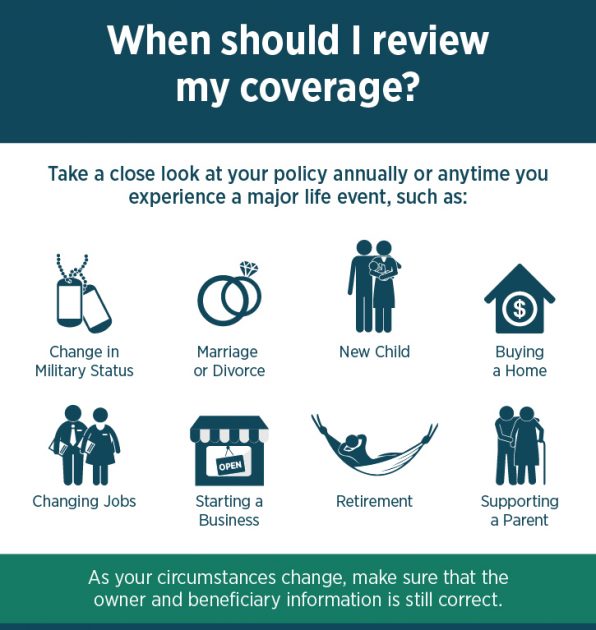

Lastly, consider organizing time yearly to examine your policy. You might intend to upgrade your beneficiary info if you have actually had any type of significant life changes, such as a marriage, birth or divorce. Life insurance coverage can often feel complicated. You don't have to go it alone. As you explore your alternatives, take into consideration discussing your demands, wants and worries about an economic professional.

No, level term life insurance policy does not have cash value. Some life insurance policies have a financial investment attribute that permits you to build money value gradually. A portion of your premium settlements is reserved and can gain interest over time, which expands tax-deferred during the life of your protection.

Nevertheless, these plans are frequently considerably much more costly than term protection. If you reach the end of your plan and are still active, the coverage ends. You have some options if you still desire some life insurance protection. You can: If you're 65 and your coverage has run out, as an example, you might wish to acquire a brand-new 10-year degree term life insurance policy policy.

Why Simplified Term Life Insurance Matters

You might be able to transform your term protection into a whole life plan that will last for the remainder of your life. Many sorts of degree term plans are convertible. That indicates, at the end of your coverage, you can transform some or every one of your policy to whole life protection.

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

A level premium term life insurance policy strategy allows you stay with your budget plan while you aid safeguard your household. Unlike some tipped price strategies that enhances annually with your age, this sort of term plan provides prices that remain the exact same for the period you choose, even as you age or your health changes.

Discover more regarding the Life Insurance policy alternatives readily available to you as an AICPA member (What is level term life insurance). ___ Aon Insurance Solutions is the trademark name for the brokerage and program management procedures of Fondness Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Policy Company, Inc. (CA 0795465); in Okay, AIS Fondness Insurance Coverage Providers Inc.; in CA, Aon Fondness Insurance Coverage Solutions, Inc .

Latest Posts

Life Burial Insurance

Over 50 Funeral Plans

Highest Paying Funeral Cover